10 Best Indian Government Investment Schemes: Building a Secure Financial Future

This comprehensive guide unravels the intricacies of 10 of the best Indian government investment schemes, empowering you to make informed decisions for your financial future.

Navigating the world of investments can be daunting, especially for those seeking the stability and security offered by government-backed schemes. In India, with its diverse and evolving financial landscape, choosing the right government investment scheme for your goals can seem like a complex puzzle. Worry not, for this comprehensive guide unravels the intricacies of 10 of the best Indian government investment schemes, empowering you to make informed decisions for your financial future.

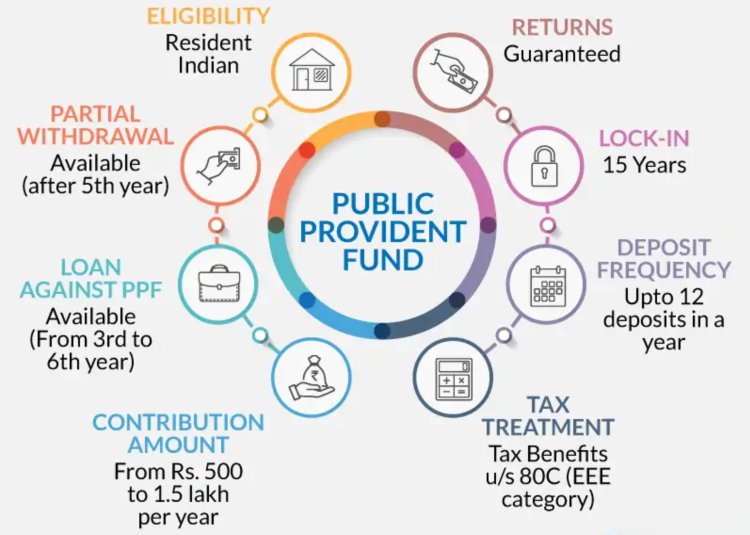

1. Public Provident Fund (PPF): The Long-Term Champion

Topping the charts is the PPF, a long-term saving and investment haven. With attractive interest rates (currently 7.1%), tax-free maturity gains, and a 15-year lock-in period, PPF fosters financial discipline while building a substantial corpus. Ideal for retirement planning and wealth creation, it allows minimum investments of Rs.500 per year, making it accessible for diverse income levels. Remember, premature withdrawals come with penalties, so align your financial goals with the lock-in period before diving in.

MUST READ: Public Provident Fund: A Secure Step Towards Financial Stability

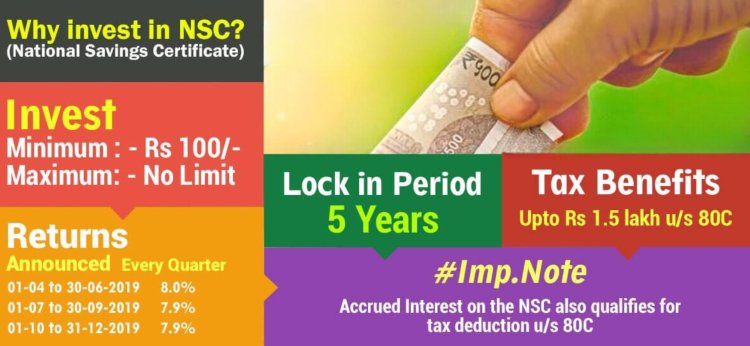

2. National Savings Certificate (NSC): The Safety Net of Growth

Seeking guaranteed returns with attractive interest rates (currently 7.7%)? Look no further than the NSC! This fixed-income scheme offers flexible tenures (5, 10, and 15 years) and minimum investments of Rs.1,000. The interest is compounded and paid at maturity, making it a great tool for long-term financial goals like children's education or retirement corpus building. NSC boasts zero market risks and tax benefits on accrued interest, making it a safe and secure investment haven.

ALSO READ: Comprehensive guide into the intricacies of NSCs

3. Sukanya Samriddhi Yojana (SSY): Nurturing Dreams for Every Girl Child

Empowering girl children with financial security is the focus of SSY. With a phenomenal interest rate of 8.0% and a 21-year tenure, it ensures your girl child's future bright. Minimum investments of Rs.250 make it accessible, and tax benefits on investment and interest further sweeten the deal. Premature withdrawals are allowed for specific purposes like girl child's marriage or higher education. Remember, this scheme is only available for a girl child below 10 years of age.

Sukanya Samriddhi Yojana: Empowering Girls, Securing Futures - A Complete Guide

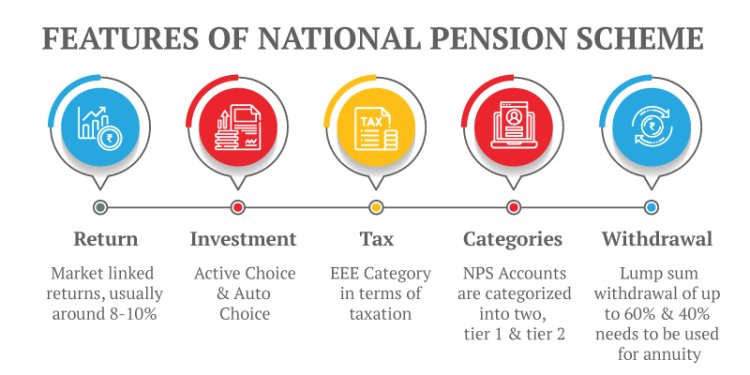

4. National Pension Scheme (NPS): Building a Golden Nest Egg for Retirement

The NPS is your key to a worry-free retirement. This pension scheme caters to all income levels, allowing minimum contributions of Rs.6,000 per year. It offers investment flexibility in equity, government bonds, and other asset classes, catering to diverse risk appetites. Tier I of the scheme mandates lock-in until retirement, while Tier II provides partial withdrawal options. Tax benefits on contributions and maturity make NPS a financially sound choice. Remember, starting early allows greater corpus accumulation through the power of compounding.

MUST READ: A Comprehensive Guide to the National Pension Scheme (NPS)

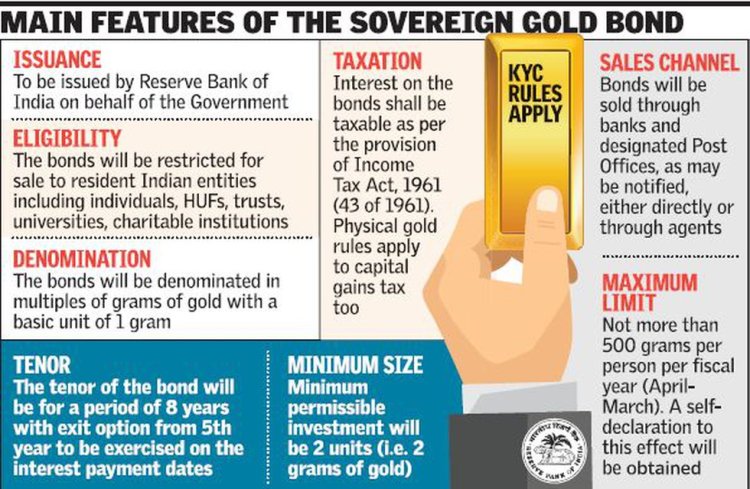

5. Sovereign Gold Bonds (SGB): Hedging Risks with the Golden Glow

SGBs offer a unique way to invest in gold without physical storage hassles. They offer attractive interest rates linked to gold prices, providing both capital appreciation and inflation protection. The minimum investment is Rs.1,000, making it accessible, and the tenure of 8 years with an exit option after 5 years adds flexibility. Exempt from capital gains tax on maturity, SGBs are a safe haven for wealth diversification and hedging against market volatility.

ALSO READ: Sovereign Gold Bonds: A Secure Way to Shine in the Golden Market

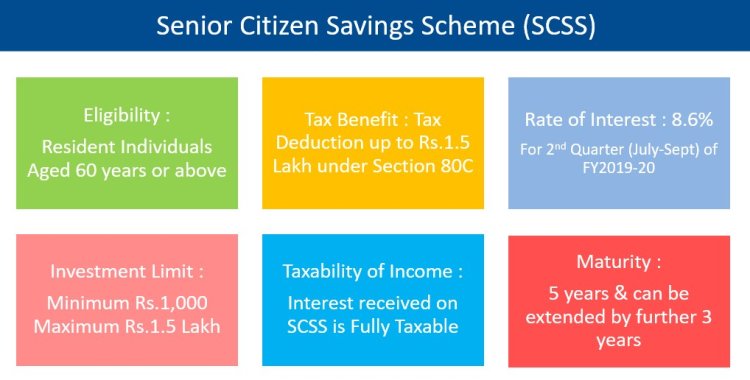

6. Senior Citizen Savings Scheme (SCSS): Golden Years, Golden Returns

Caring for our elders is paramount, and the SCSS reflects this beautifully. This scheme offers senior citizens above 60 years of age a secure income stream with a high interest rate (currently 7.6%). The tenure is 5 years, with renewal options, and the minimum investment is Rs.1,000. Tax benefits on interest further enhance its appeal. SCSS provides financial security and peace of mind during the golden years.

TOP READ: Senior Citizen Savings Scheme: A Secure Haven for Retirement Income in India

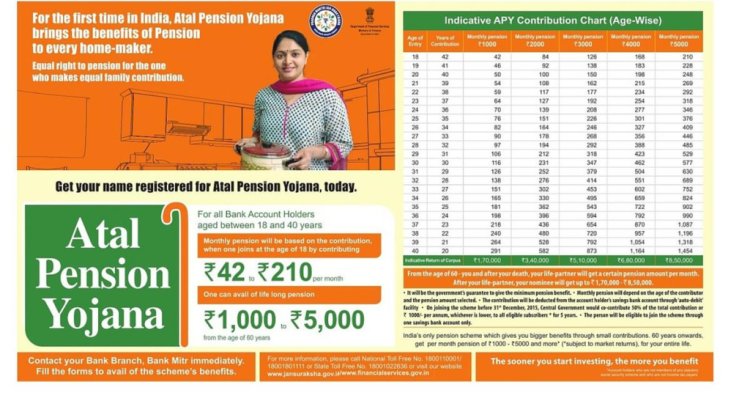

7. Atal Pension Yojana (APY): Micro-Pensions, Macro Impact

The APY empowers all citizens, especially those in the unorganized sector, to secure a regular pension after retirement. With minimum monthly contributions of Rs.20 to Rs.500, depending on the desired pension amount, APY is highly accessible. Tax benefits on contributions add to its attractiveness. Remember, the scheme is available only to individuals between 18 and 40 years of age, and the pension will start after attaining 60 years.

OUR PICK: Atal Pension Yojana: Securing Your Golden Years in India

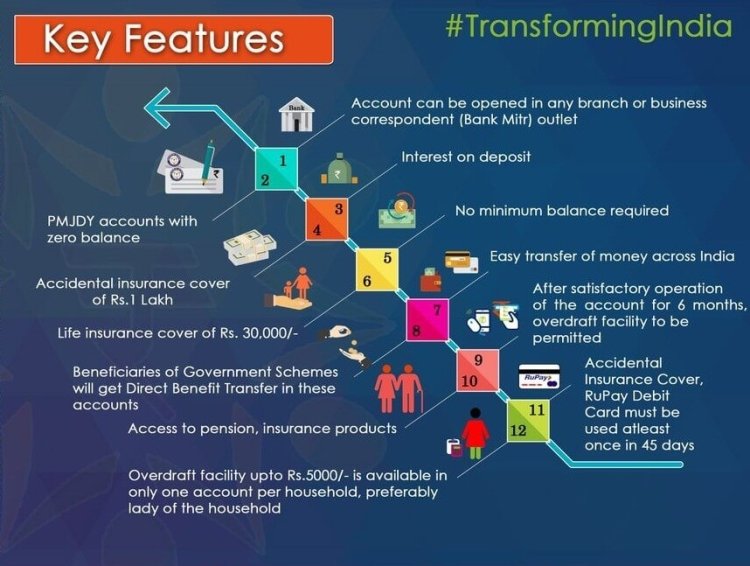

8. Pradhan Mantri Jan Dhan Yojana (PMJDY): Inclusive Banking, Investment Opportunities

Financial inclusion and empowerment are at the heart of PMJDY. This scheme provides access to savings accounts, overdraft facilities, and insurance to financially excluded individuals. While not directly an investment scheme, PMJDY empowers individuals to save and accumulate funds, paving the way for future investments in schemes like Sukanya Samriddhi Yojana for their daughters or Atal Pension Yojana for their own retirement. Additionally, overdraft facilities can be used for emergencies or small business ventures, promoting financial independence.

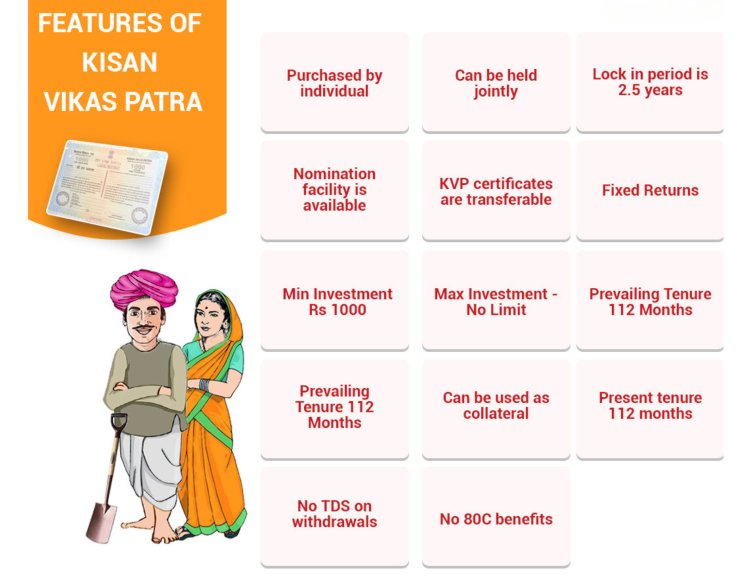

9. Kisan Vikas Patra (KVP): Savings with a Rural Touch

Catering specifically to the needs of farmers and rural communities, KVP offers attractive interest rates (currently 7.7%) along with a short and flexible tenure of 124 months. Minimum investments of Rs.1,000 make it accessible, and the certificate doubles the invested amount at maturity, providing capital appreciation. KVP is exempt from tax on maturity, making it a compelling option for rural investors seeking both growth and security.

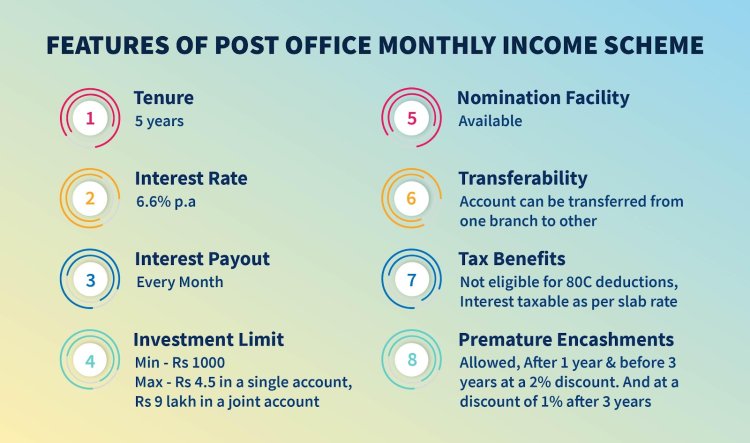

10. Post Office Monthly Income Scheme (POMIS): Regular Income, Reliable Source

Seeking a steady monthly income stream? POMIS, offered by the Post Office, could be your answer. With tenures of 5 or 6 years, POMIS offers minimum investments of Rs.1,000 and monthly payouts linked to the invested amount. Interest rates are attractive (currently 7.1%), and tax benefits on interest earned add to the appeal. POMIS is ideal for retirees or individuals seeking regular income for specific needs, like paying off loans or meeting monthly expenses.

Choosing the Right Scheme: Know Your Needs, Assess Your Risk

Selecting the best Indian government investment scheme for you depends on several factors. Consider your:

- Financial goals: Are you saving for retirement, a child's education, or a rainy day? Align your chosen scheme with your long-term goals.

- Risk appetite: Are you comfortable with market fluctuations, or do you prefer guaranteed returns? Choose schemes that match your risk tolerance.

- Investment horizon: How long can you stay invested? Match your time frame with the scheme's lock-in period or tenure.

- Tax benefits: Look for schemes that offer tax benefits on investments, interest earned, or maturity amounts to maximize your returns.

Seek Professional Guidance: Invest Wisely

While these ten schemes offer a glimpse into the diverse landscape of Indian government investments, consulting a financial advisor can be invaluable. They can assess your individual needs, risk profile, and financial goals and recommend the most suitable schemes for you, ensuring a secure and prosperous future.

Remember, investing is a marathon, not a sprint. Choose wisely, stay disciplined, and watch your wealth grow steadily under the safe haven of Indian government investment schemes.

In addition to the ten schemes mentioned above, here are some other noteworthy options to consider:

- Gold Monetization Scheme: This scheme allows you to deposit your gold holdings in banks and earn interest on them, eliminating storage hassles.

- Bharat Bond ETF: This exchange-traded fund invests in government bonds, offering a convenient way to access fixed income through the stock market.

- Senior Citizen Bonds: These bonds offer high interest rates exclusively to senior citizens, providing a secure income stream during their golden years.

Investing in Indian government schemes can be a rewarding experience, providing you with financial security, tax benefits, and peace of mind. By understanding your needs and choosing the right schemes, you can build a strong financial foundation for yourself and your loved ones.

I hope this comprehensive guide has empowered you to navigate the world of Indian government investment schemes with confidence. Remember, knowledge is power, and with the right information, you can make informed decisions and build a secure financial future for yourself and your family.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a qualified financial advisor before making any investment decisions.

Additional Resources:

- Ministry of Finance, Government of India: https://finmin.nic.in/

- Securities and Exchange Board of India (SEBI): https://www.sebi.gov.in/

- Pension Fund Regulatory and Development Authority (PFRDA): https://www.pfrda.org.in/

What's Your Reaction?