Sovereign Gold Bonds: A Secure Way to Shine in the Golden Market

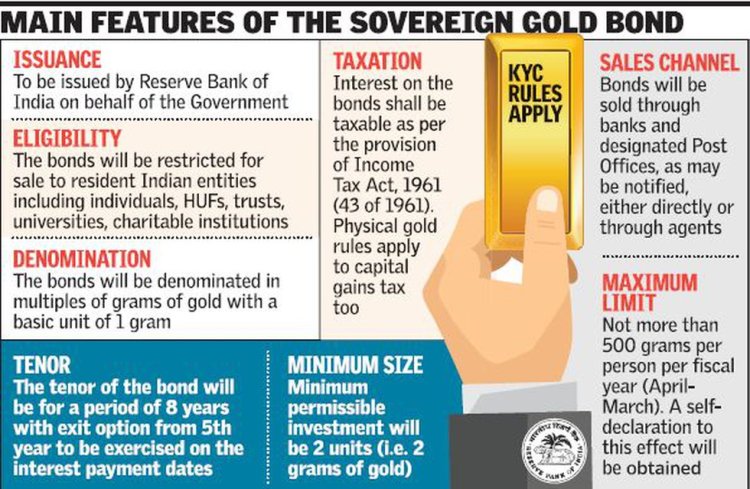

Sovereign Gold Bonds, issued by the Reserve Bank of India (RBI) on behalf of the Government of India, are essentially government securities denominated in grams of gold. Think of them as gold-backed bonds, where you invest in gold at the current market price and receive the equivalent value in rupees at maturity, along with an additional fixed interest rate.

Gold, the eternal allure, has captivated hearts and economies for millennia. Its timeless shine and perceived stability have made it a coveted asset, often passed down through generations. But owning physical gold comes with its own set of challenges – storage costs, security concerns, and fluctuating market prices. Enter the Sovereign Gold Bond (SGB), a financial instrument designed to offer the benefits of gold ownership without the hassles.

What are Sovereign Gold Bonds?

Sovereign Gold Bonds, issued by the Reserve Bank of India (RBI) on behalf of the Government of India, are essentially government securities denominated in grams of gold. Think of them as gold-backed bonds, where you invest in gold at the current market price and receive the equivalent value in rupees at maturity, along with an additional fixed interest rate.

Why Choose SGBs over Physical Gold?

The convenience and security SGBs offer make them a compelling alternative to physical gold. Here's why:

- Eliminate Storage Worries: No more fretting about secure lockers, insurance costs, or the risk of theft. SGBs are held electronically in the RBI's or your demat account, ensuring complete safety and peace of mind.

- Liquidity without hassles: Unlike physical gold, which requires finding buyers and dealing with purity certification, SGBs can be easily traded on stock exchanges or redeemed before maturity through designated banks.

- Guaranteed Gold Purity: No need to worry about the authenticity of your gold. SGBs are backed by the sovereign guarantee of the Government of India, ensuring 999 purity.

- Regular Income: Earn a fixed interest of 2.50% per annum on the initial investment, providing an additional return on your gold holding.

- Tax Benefits: Enjoy capital gains tax exemption on redemption if held till maturity, making SGBs a tax-efficient investment option.

Investing in Sovereign Gold Bonds:

SGBs are typically issued in six-month tranches, with subscription periods open for a few days. You can invest through commercial banks, authorized stock exchanges, and designated post offices. The minimum investment is 1 gram, and the maximum limit is 4 kg for individuals and Hindu Undivided Families (HUFs), and 20 kg for institutions.

Key Features of SGBs:

- Tenure: 8 years with an exit option after 5 years at interest payment dates.

- Denomination: Multiples of 1 gram of gold.

- Interest Rate: Fixed 2.50% per annum, payable semi-annually.

- Redemption Price: Based on the average closing price of gold of 999 purity for the three working days preceding the redemption date.

- Liquidity: Tradable on stock exchanges after five years or premature redemption through designated banks.

Who Should Invest in SGBs?

SGBs cater to a diverse range of investors seeking to add the stability of gold to their portfolios:

- Risk-averse Investors: For those seeking a secure investment with capital protection and steady returns, SGBs offer a valuable hedge against inflation and market volatility.

- Long-term Investors: With their tax benefits and potential for capital appreciation, SGBs are ideal for long-term wealth creation goals like retirement planning.

- Gold Enthusiasts: For those who appreciate gold but wish to avoid the hassles of physical ownership, SGBs provide a convenient and secure way to participate in the gold market.

Beyond the Gleam: Considerations before Investing in SGBs

While SGBs offer numerous advantages, it's crucial to understand their limitations before investing:

- No Physical Gold Delivery: You don't receive physical gold at maturity; the redemption value is settled in rupees based on the gold price.

- Interest Rate Risk: The fixed interest rate is lower than potential returns from physical gold in a bull market.

- Liquidity Risk: Trading volumes on stock exchanges may be limited, impacting liquidity, especially for premature redemption.

Deeper Dive into SGB Advantages and Risks

Advantages Beyond the Surface:

While the convenience and security of SGBs are well-established, let's delve deeper into some lesser-known benefits:

- Ease of Gifting: SGBs can be conveniently gifted to loved ones, making them a unique and valuable present for special occasions.

- Collateral for Loans: They can be used as collateral for loans, providing access to funds without liquidating the underlying gold.

- Estate Planning Tool: By naming joint holders or nominees, SGBs can simplify succession planning and ensure smooth transfer of wealth within families.

- Diversification: Adding SGBs to your portfolio can reduce dependence on traditional assets like stocks and bonds, creating a more diversified and resilient investment mix.

Unveiling the Potential Risks:

A comprehensive understanding of SGBs necessitates a balanced view, including potential drawbacks:

- Currency Fluctuations: If the rupee strengthens against gold, the rupee redemption value at maturity might be lower than the initial investment.

- Interest Rate Comparison: Compared to other fixed-income instruments like government bonds, the 2.50% interest rate might seem less attractive in low-interest environments.

- Early Exit Penalty: Premature redemption before five years incurs an interest penalty, reducing the overall return.

- Market Volatility: While gold offers stability, the redemption price is still subject to market fluctuations, potentially leading to lower returns than anticipated.

Making the Right Choice:

With a clear understanding of both the advantages and risks, you can now make an informed decision about whether SGBs are the right fit for your portfolio. Consider these factors:

- Investment Objective: Are you seeking capital protection, steady income, or potential for capital appreciation?

- Risk Tolerance: How comfortable are you with market fluctuations and the possibility of lower returns?

- Investment Horizon: Are you planning for a long-term investment or looking for short-term liquidity?

- Portfolio Mix: How will SGBs complement your existing investments and diversify your overall portfolio?

Consulting with a Financial Expert:

Navigating the intricacies of financial markets can be complex. A qualified financial advisor can assess your individual circumstances, risk profile, and financial goals to create a personalized investment plan that includes SGBs or other suitable options. Remember, this is a crucial step in ensuring your investment decisions are aligned with your financial aspirations.

Shining Bright Your Financial Future:

Sovereign Gold Bonds, with their unique blend of convenience, security, and potential returns, offer a compelling proposition for investors seeking stability and diversification. By carefully weighing the advantages and risks, conducting thorough research, and seeking professional guidance, you can confidently add a touch of golden brilliance to your investment portfolio and illuminate your path towards a secure financial future.

Disclaimer:

This article is for informational purposes only and should not be construed as financial advice. Individual circumstances vary, and what works for one person may not work for another. Please consult with a qualified financial advisor or investment professional before making any investment decisions.

The information contained in this article has been obtained from sources believed to be reliable, but no guarantee is made as to its accuracy or completeness. Past performance is not a guarantee of future results, and any forecasts or opinions expressed herein may be subject to change without notice.

Important Links:

- Reserve Bank of India - Sovereign Gold Bonds: https://m.rbi.org.in/scripts/BS_SwarnaBharat.aspx

- Ministry of Finance - Sovereign Gold Bonds FAQs: https://finmin.nic.in/swarnabharat/sovereign-gold-bond.html

- ClearTax - Taxation Guide for Sovereign Gold Bonds: https://www.bajajfinservmarkets.in/sovereign-gold-bond/tax-implications-on-sgb.html

Additional Resources:

- World Gold Council: https://www.gold.org/

- National Stock Exchange of India - Sovereign Gold Bonds: https://www.nseindia.com/market-data/sovereign-gold-bond

By accessing and using this article, you agree to the terms and conditions stated above.

What's Your Reaction?