Public Provident Fund: A Secure Step Towards Financial Stability

This article delves deep into the intricacies of the PPF, empowering you to make informed decisions about your financial future.

In the realm of personal finance, navigating the myriad investment options can be daunting. Yet, amidst the complexities, stands a stalwart figure – the Public Provident Fund (PPF). Introduced in 1968 by the National Savings Institute of India, the PPF has carved a niche as a reliable and tax-efficient tool for long-term wealth creation. This article delves deep into the intricacies of the PPF, empowering you to make informed decisions about your financial future.

Understanding the Fundamentals of PPF:

At its core, the PPF is a government-backed savings scheme designed to promote long-term savings habits and offer attractive returns. It caters to individuals seeking a secure avenue to invest their money while reaping the benefits of tax exemptions. Opening a PPF account is a straightforward process, accessible through designated branches of authorized banks and post offices.

Key Features of the PPF:

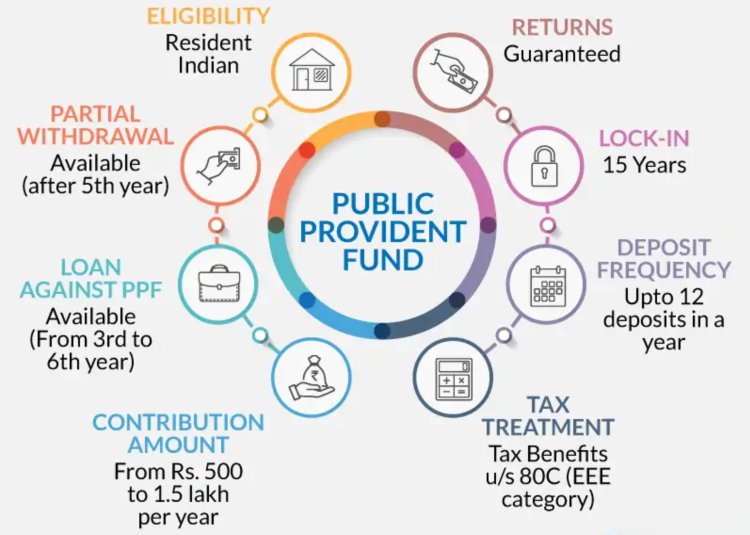

- Minimum Deposit and Maximum Limit: You can commence your PPF journey with a minimum deposit of ₹500 per year, making it an accessible option for individuals across income brackets. However, the annual ceiling for contributions stands at ₹1.5 lakhs, ensuring responsible financial planning.

- Guaranteed Returns: Unlike market-linked instruments, the PPF boasts the comfort of guaranteed returns. The interest rate is revised quarterly by the government, currently standing at 7.1% per annum (as of January 2024). This stability in returns is particularly appealing to risk-averse investors.

- Compounded Interest: The magic of compounding interest works its wonders in a PPF account. Interest earned is added to the principal amount each year, leading to accelerated growth over the long term.

- Tax Benefits: The PPF is a haven for tax-conscious individuals. Contributions made to the PPF qualify for deduction under Section 80C of the Income Tax Act, thereby reducing your taxable income. Furthermore, the interest earned and the maturity amount are completely exempt from income tax, making it a truly tax-efficient investment.

- Lock-in Period: To encourage long-term commitment, the PPF has a lock-in period of 15 years. However, partial withdrawals are permitted from the 7th year onwards, subject to certain conditions.

- Maturity and Extension: Upon reaching maturity, you have the option to extend your PPF account in blocks of 5 years, allowing you to continue enjoying the benefits of tax-free returns and compounded interest. Alternatively, you can choose to withdraw the entire maturity amount.

Benefits of Investing in PPF:

Beyond the financial advantages, the PPF offers a plethora of benefits that contribute to overall financial well-being:

- Safe and Secure: Backed by the government, the PPF provides unparalleled security for your investments, minimizing the risk of loss.

- Disciplined Savings: The fixed deposit schedule fosters a habit of regular savings, inculcating financial discipline and paving the path for future financial security.

- Retirement Planning: The PPF serves as an ideal tool for retirement planning, offering a steady stream of income post-retirement.

- Emergency Fund: The partial withdrawal facility allows you to access a portion of your funds in case of unforeseen circumstances, acting as a safety net during challenging times.

Suitability of PPF:

The PPF caters to a diverse range of individuals, particularly those seeking:

- Long-term wealth creation: With its attractive returns and compounded interest, the PPF is well-suited for individuals with long-term investment horizons, such as retirement planning or children's education.

- Tax-efficient investments: For individuals seeking to minimize their tax burden, the PPF's tax-free returns and deductions make it an indispensable tool.

- Safe and secure investments: Risk-averse individuals seeking stability and security in their investments find solace in the government-backed nature of the PPF.

Comparison with other Investment Options:

While the PPF shines in its own right, understanding its position relative to other investment options can aid in informed decision-making:

- Fixed Deposits: Compared to fixed deposits, the PPF offers higher returns and tax benefits, making it a more attractive option for long-term goals.

- Debt Mutual Funds: Debt mutual funds can potentially offer higher returns than the PPF, but they come with associated market risks. The PPF, with its guaranteed returns and tax benefits, stands out as a safer option for risk-averse individuals.

- Equity Mutual Funds: Equity mutual funds have the potential for significantly higher returns than the PPF, but they are also exposed to market volatility. The PPF, therefore, acts as a valuable diversifying tool within a portfolio, providing stability and tax benefits.

Maximizing your PPF Returns:

To optimize your PPF experience, consider these actionable tips:

- Start Early: The earlier you start investing in PPF, the more time your money has to grow through the power of compounding interest. Even small contributions made consistently over a long period can accumulate into a substantial sum.

- Utilize the Full Annual Limit: Contribute the maximum permissible amount of ₹1.5 lakhs each year to maximize your returns and take full advantage of the tax benefits.

- Maintain Regular Deposits: Consistency is key in maximizing your PPF returns. Set up a standing instruction with your bank or post office to ensure timely contributions and avoid missing out on interest.

- Take Advantage of Compounding: Don't withdraw your interest earnings prematurely. Let them remain invested to benefit from compounding, where the interest earned on interest accelerates your wealth growth.

- Extend Your PPF Account: Upon maturity, consider extending your PPF account in blocks of 5 years. This allows you to continue enjoying the tax-free returns and compounded interest without having to reinvest the maturity amount in another instrument.

- Combine with Other Investment Options: While the PPF is an excellent long-term investment, diversify your portfolio with other instruments like equity mutual funds to potentially achieve higher returns and hedge against inflation.

Beyond the Numbers: PPF and Financial Stability:

The impact of the PPF extends beyond mere financial figures. By promoting regular savings and tax-efficient investments, the PPF fosters financial discipline and empowers individuals to achieve their long-term goals. This sense of security and preparedness contributes to overall well-being and reduces stress related to financial uncertainty.

For young individuals, the PPF can be the foundation for a secure future. Regular contributions during their earning years can build a significant corpus by the time they retire, ensuring a comfortable lifestyle post-retirement. Similarly, parents can utilize the PPF to plan for their children's education or marriage, providing them with a head start in life.

In conclusion, the Public Provident Fund stands as a testament to the power of long-term planning and disciplined saving. Its unwavering commitment to security, stability, and tax-efficiency makes it a valuable tool for individuals from all walks of life. Whether you're a young professional, a parent planning for your child's future, or someone nearing retirement, the PPF offers a secure and rewarding path towards financial stability and a peaceful future.

What's Your Reaction?