Securing Your Golden Years: A Comprehensive Guide to the National Pension Scheme (NPS)

This article delves deep into the intricacies of NPS, demystifying its features, benefits, and nuances to empower you to make informed decisions about your retirement planning.

As life expectancy rises and traditional pension systems evolve, securing a comfortable retirement becomes an increasingly personal responsibility. In India, the National Pension Scheme (NPS) emerges as a powerful tool for building a stable financial future after our working years are over. This article delves deep into the intricacies of NPS, demystifying its features, benefits, and nuances to empower you to make informed decisions about your retirement planning.

Understanding the Landscape: What is NPS?

Launched in 2004 by the Government of India, NPS is a voluntary, market-linked pension scheme designed to supplement existing retirement income sources. Unlike the defined-benefit schemes of the past, NPS operates on a defined-contribution basis. This means subscribers make regular contributions into their own individual pension accounts throughout their working life, and the accumulated corpus is then used to provide a monthly pension upon retirement.

Navigating the Tiers: Account Options within NPS

NPS encompasses two tiers of accounts:

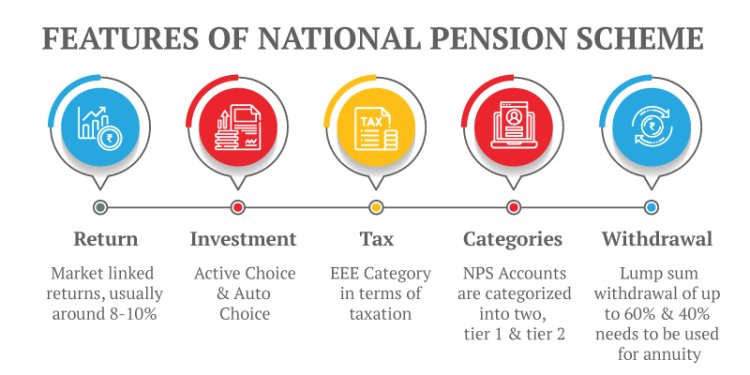

- Tier I Account: This is the mandatory account for government employees joining service after 2004 and all Indian citizens aged 18-70 who voluntarily choose to join the scheme. Contributions made to Tier I account qualify for tax deductions under Section 80C of the Income Tax Act, offering substantial benefits.

- Tier II Account: This is an optional supplementary account open to anyone with an active Tier I account. Unlike Tier I, contributions to Tier II do not qualify for tax deductions but offer greater flexibility in terms of withdrawal options.

Charting Your Course: Investment Choices and Fund Allocation

Investing your NPS contributions is a crucial aspect of building a robust retirement corpus. The scheme offers a diverse range of fund options managed by professional Pension Fund Managers (PFMs). You can choose from equity, debt, or hybrid funds based on your risk appetite and investment horizon. Additionally, NPS boasts an "Auto Choice" feature that automatically adjusts your asset allocation based on your age, ensuring a balanced portfolio throughout your contribution period.

Building the Nest Egg: Contribution Options and Minimum Requirements

Flexibility is a hallmark of NPS. Contributors can choose their frequency of contributions – monthly, quarterly, or half-yearly – and define the amount based on their budget and financial goals. However, a minimum annual contribution of INR 6,000 is mandatory for Tier I accounts. Tax-saving contributions through Tier I, however, have a higher ceiling of INR 1.5 lakh per year.

Harvesting the Fruits: Withdrawal Options and Annuity Choices

Upon reaching retirement age (60 years or later), subscribers can access their NPS corpus in three ways:

- 40% as lump sum: This tax-free withdrawal allows for immediate liquidity needs while the remaining 60% is used to purchase an annuity for monthly pension income.

- 60% as annuity: This option ensures a steady stream of income throughout your retirement.

- Combining both: You can withdraw 40% as a lump sum and utilize the remaining 60% for annuity purchase.

It's important to note that the scheme also offers limited pre-retirement withdrawal options for specific circumstances like medical emergencies or higher education expenses.

Beyond the Basics: Additional Features and Advantages

NPS goes beyond a mere retirement savings tool. Here are some key benefits it offers:

- Portability: Your NPS account moves seamlessly with you if you change jobs or locations, ensuring uninterrupted contributions and continuity in your retirement plan.

- Tax benefits: Apart from Section 80C deductions, additional tax exemptions are available on annuity income and lump sum withdrawals at retirement.

- Government co-contribution: For NPS subscribers under the age of 40, the government contributes an additional 10% of your annual contributions up to INR 5,000 per year, boosting your corpus significantly.

- Transparency and regulation: NPS functions under the stringent oversight of the Pension Fund Regulatory and Development Authority (PFRDA), ensuring transparency and safety of your investments.

Challenges and Considerations: Knowing the Flipside

While NPS offers immense advantages, it's crucial to understand its limitations as well:

- Long lock-in period: Access to a significant portion of your corpus is restricted until retirement, requiring long-term financial planning.

- Market volatility: As a market-linked scheme, NPS returns are subject to market fluctuations, potentially impacting your final corpus.

- Annuity dependence: Post-retirement, a significant portion of your corpus is locked into an annuity, limiting immediate financial flexibility.

Making Informed Choices: Tailor-fitting NPS to Your Needs

NPS is a valuable tool for securing a financially secure retirement, but its effectiveness relies on personalized planning. Here are some steps to consider:

Assess your financial goals and risk appetite: Determine your target retirement corpus and preferred investment profile to choose the right combination of funds and contribution amounts.

-

Seek professional guidance: Consulting a financial advisor familiar with NPS can be incredibly helpful in navigating the nuances of the scheme and aligning it with your overall financial plan.

-

Start early, contribute regularly: The power of compounding works best when initiated early. Starting contributions early and maintaining regular investments, even at modest amounts, can significantly inflate your retirement corpus over time.

-

Review and adjust: Your risk tolerance and financial goals may evolve over time. Periodically reviewing your NPS investment choices and contribution levels ensures your scheme remains aligned with your changing needs.

Beyond the Individual: NPS: A Societal Imperative

The broader significance of NPS extends beyond individual benefits. By encouraging long-term savings and creating a pool of investable capital, NPS contributes to the development of a robust and stable financial system in India. It fosters financial inclusion by extending pension benefits to the unorganized sector and promotes self-reliance among citizens, reducing dependence on social security schemes in the long run.

NPS: A Beacon for a Secure Future

In conclusion, the National Pension Scheme presents a compelling proposition for anyone seeking to build a secure and financially independent future. While understanding its limitations and tailoring it to your individual needs is crucial, NPS's flexibility, tax benefits, and long-term growth potential make it a powerful tool for securing your golden years. So, take the first step today, explore the benefits of NPS, and pave the way for a comfortable and financially dignified retirement journey.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as financial advice. Individual circumstances may vary, and you should always consult with a qualified financial advisor before making any investment decisions. Past performance is not necessarily indicative of future results, and investment in NPS involves market risks. This article does not guarantee the accuracy or completeness of the information presented and is not to be held liable for any errors or omissions.

Important Links

- Pension Fund Regulatory and Development Authority (PFRDA): https://www.pfrda.org.in/

- NPS official website: https://enps.nsdl.com/eNPS/NationalPensionSystem.html

- Ministry of Finance: https://financialservices.gov.in/

- NPS e-NPS website: https://enps.nsdl.com/eNPS/NationalPensionSystem.html

- PFRDA grievance redressal mechanism: https://www.pfrda.org.in/

What's Your Reaction?