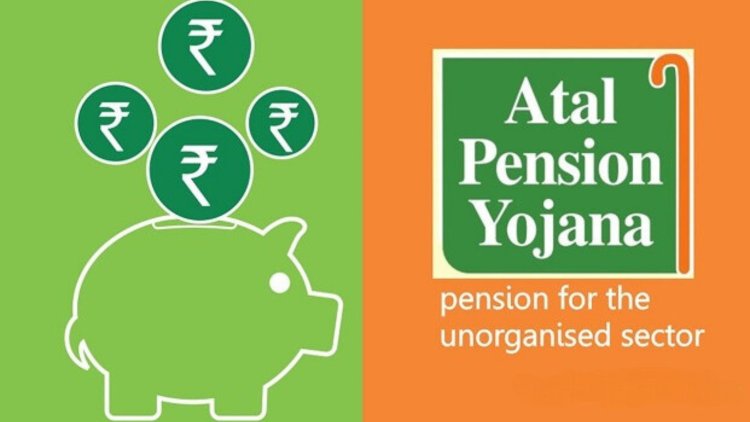

Atal Pension Yojana: Securing Your Golden Years in India

Launched in 2015 by former Prime Minister Atal Bihari Vajpayee, Atal Pension Yojana has emerged as a beacon of hope for millions of Indians, empowering them to plan for a financially secure twilight of their lives.

In a nation brimming with youthful energy, the looming shadow of an uncertain future for senior citizens can often be overlooked. However, the Indian government, recognizing this critical need, has implemented the Atal Pension Yojana (APY), a revolutionary scheme aimed at providing guaranteed monthly pensions to citizens of the unorganized sector after they reach the age of 60. Launched in 2015 by former Prime Minister Atal Bihari Vajpayee, APY has emerged as a beacon of hope for millions of Indians, empowering them to plan for a financially secure twilight of their lives.

Understanding the Core of APY:

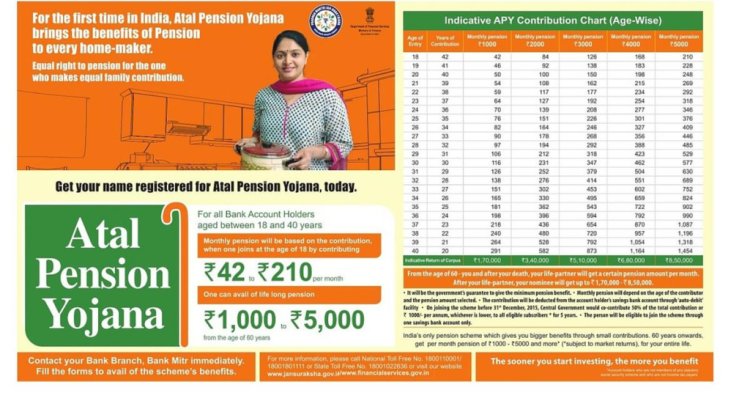

At its core, APY is a voluntary, defined contribution pension scheme designed specifically for individuals between the ages of 18 and 40 years who work in the unorganized sector. This sector encompasses a vast array of professions, including farmers, street vendors, rickshaw drivers, and domestic workers, who often lack access to formal pension plans. Through APY, these individuals can contribute a fixed monthly amount, ranging from Rs. 100 to Rs. 500, depending on their desired pension amount at the age of 60. The government, in a remarkable gesture of support, co-contributes an additional amount to the subscriber's account until they reach the age of 55.

Benefits that Make APY Stand Out:

- Guaranteed Minimum Pension: Upon reaching 60 years of age, subscribers are entitled to a guaranteed minimum monthly pension ranging from Rs. 1,000 to Rs. 5,000, depending on their chosen contribution tier. This fixed income provides financial stability and security in the later years of life.

- Government Co-contribution: The government's co-contribution adds a significant boost to the subscriber's corpus, effectively amplifying their long-term savings. This additional support is particularly beneficial for low-income individuals who might otherwise struggle to save for their retirement.

- Tax Benefits: APY comes with attractive tax benefits. Contributions made to the scheme are eligible for deduction under Section 80CCD of the Income Tax Act, 1961, thereby reducing the subscriber's taxable income. Additionally, the pension received at the age of 60 is exempt from income tax.

- Simple and Accessible: Joining APY is a straightforward process that can be completed at any bank or post office offering the scheme. The minimal documentation required and the ease of contribution through auto-debit further enhance its accessibility for individuals from diverse backgrounds.

- Spousal and Family Security: In the unfortunate event of the subscriber's demise before reaching 60, the spouse is entitled to the same pension amount as the subscriber. Additionally, the nominee appointed by the subscriber receives the accumulated pension corpus. This ensures financial security for the subscriber's loved ones even in unforeseen circumstances.

Beyond the Numbers: The Human Impact of APY

The impact of APY extends far beyond mere financial figures. It instills a sense of security and hope in the lives of millions who were previously staring at an uncertain future. For a farmer in rural India, knowing that a steady income awaits him after years of toil under the sun provides immense peace of mind. For a street vendor, the prospect of financial independence in her golden years fuels her entrepreneurial spirit. APY empowers individuals to take control of their destiny, break free from the shackles of financial insecurity, and live their later years with dignity and grace.

Contribution Tiers and Pension Amounts:

APY offers five distinct contribution tiers, each corresponding to a specific monthly pension amount at the age of 60. Understanding these tiers can help individuals make informed decisions based on their desired financial security in retirement.

- Tier 1: For a monthly contribution of Rs. 100, subscribers can receive a minimum pension of Rs. 1,000 at the age of 60. This tier is ideal for individuals with limited income who prioritize basic financial security in their later years.

- Tier 2: A monthly contribution of Rs. 130 entitles subscribers to a minimum pension of Rs. 1,300 upon reaching 60. This tier offers a slightly higher income stream compared to tier 1, catering to individuals seeking moderate financial comfort.

- Tier 3: Contributing Rs. 210 per month allows individuals to receive a minimum pension of Rs. 2,000 at the age of 60. This tier targets individuals who can afford higher contributions and desire a more comfortable retirement lifestyle.

- Tier 4: This tier requires a monthly contribution of Rs. 290 and rewards subscribers with a minimum pension of Rs. 2,700 at the age of 60. It is suited for individuals with relatively higher income levels aiming for a financially secure and independent retirement.

- Tier 5: The highest tier of APY requires a monthly contribution of Rs. 500 and guarantees a minimum pension of Rs. 5,000 at the age of 60. This tier caters to individuals seeking a substantial income stream in their later years and who have the financial capacity to contribute accordingly.

Success Stories: The Human Face of APY:

To truly understand the impact of APY, it's crucial to go beyond statistics and delve into the lives of individuals whose futures have been transformed by the scheme. Here are a few examples:

- Sunita Devi, a vegetable vendor in Delhi: Sunita, who barely earned Rs. 200 per day, initially dismissed APY as something beyond her reach. However, with encouragement from a local NGO, she decided to enroll in the Rs. 100 contribution tier. Now, with a guaranteed Rs. 1,000 pension awaiting her at 60, Sunita feels a sense of security and hope for her future, allowing her to focus on her business with renewed confidence.

- Rajaram, a farmer in rural Maharashtra: Rajaram, burdened by years of drought and unpredictable income, had always feared a bleak future. Joining APY in the Rs. 210 contribution tier brought a ray of hope. The prospect of a Rs. 2,000 monthly pension has instilled a sense of financial stability in his family, enabling him to invest in his farm and plan for his children's education with a newfound optimism.

- Mala, a domestic worker in Kolkata: Mala, working long hours with meager wages, had previously resigned herself to a life of financial uncertainty in her older years. Discovering APY through a government awareness campaign, she opted for the Rs. 130 contribution tier. Knowing that a minimum of Rs. 1,300 will support her after she stops working has empowered her to demand fair wages and negotiate better working conditions.

These are just a few examples of how APY has transformed the lives of everyday individuals. Every success story showcases the scheme's power to alleviate anxieties about the future, promote financial independence, and contribute to a more dignified and fulfilling later life for millions of Indians.

Enhancing Outreach and Accessibility:

While APY has undoubtedly made significant strides, reaching every potential beneficiary in the vast and diverse unorganized sector remains a challenge. To bridge this gap, collaborative efforts are crucial:

- Financial institutions: Banks and microfinance institutions can play a vital role by setting up dedicated APY desks, offering simplified documentation processes, and conducting targeted awareness campaigns within their client communities.

- NGOs and community organizations: Partnering with grassroots NGOs and community organizations with deep reach in rural and remote areas can help raise awareness and address information gaps among potential beneficiaries.

- Tech-enabled solutions: Leveraging technology through mobile apps, online platforms, and SMS campaigns can simplify access to information, enable online enrollment, and facilitate easy contribution tracking.

- Financial literacy programs: Incorporating APY awareness into financial literacy programs aimed at the unorganized sector can empower individuals to make informed decisions about their future financial security.

By combining government initiatives, institutional partnerships, and technology-driven solutions, APY can effectively reach every corner of the unorganized sector and ensure that the promise of a secure and dignified retirement becomes a reality for millions of Indians.

Conclusion:

The Atal Pension Yojana is not just a financial scheme; it is a symbol of hope and empowerment for millions of Indians from the unorganized sector. By providing a guaranteed monthly pension in their golden years, APY offers financial security, reduces anxieties about the future, and fosters a sense of dignity and independence. As the scheme continues to evolve and expand its reach, its impact will undoubtedly be felt in the improved living standards and enhanced well-being of generations to come. However, addressing existing challenges and fostering collaborative efforts remain crucial to ensure that APY reaches every potential beneficiary and fulfills its potential as a transformative force in the lives of countless individuals.

Beyond Outreach: Fostering a Culture of Financial Planning:

While expanding awareness and simplifying access are vital, building a sustainable future for APY requires encouraging a culture of financial planning within the unorganized sector. This can be achieved through:

- Long-term financial education: Integrating financial planning modules into vocational training programs and community awareness campaigns can equip individuals with basic financial literacy skills and encourage them to plan for their long-term financial needs.

- Retirement planning workshops: Conducting targeted workshops tailored to the specific needs and concerns of individuals from different sub-sectors within the unorganized sector can provide practical guidance on choosing appropriate APY tiers and calculating future financial requirements.

- Peer-to-peer learning: Encouraging existing APY subscribers to share their experiences and success stories with their peers can act as a powerful tool to dispel misconceptions and generate organic interest in the scheme.

- Micro-savings initiatives: Promoting micro-savings schemes alongside APY enrollment can help individuals develop the habit of regular saving, making even small contributions feel more manageable and impactful over time.

By fostering a culture of financial planning and responsible saving, APY can move beyond merely providing a pension to empowering individuals to take control of their financial future and make informed decisions for their long-term well-being.

Investing in the Future: A Collective Responsibility:

The success of APY ultimately rests on a collective effort from various stakeholders. The government must continue to play a vital role in expanding outreach, simplifying procedures, and promoting awareness. Financial institutions need to act as bridges, tailoring their services and products to the specific needs of the unorganized sector and actively promoting APY enrollment. NGOs and community organizations can serve as trusted guides, building awareness and providing localized support to potential beneficiaries. Finally, individuals themselves must embrace the opportunity and understand the long-term benefits of planning for their future through APY.

By working together, we can ensure that APY reaches its full potential, transforming the lives of millions of Indians in the unorganized sector and creating a nation where a dignified and secure retirement is not a privilege, but a basic right for all.

Disclaimer:

This article is intended for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

The information presented in this article is based on publicly available data and resources as of January 6, 2024. It is possible that certain details, regulations, or benefits associated with the Atal Pension Yojana may change over time. We encourage readers to visit the official government website or contact authorized representatives for the latest information.

Important Links:

- Atal Pension Yojana Official Website: https://www.pfrda.org.in/

- APY FAQs: https://www.pfrda.org.in/

- How to Join APY: https://www.pfrda.org.in/

- List of APY Service Providers: https://www.pfrda.org.in/

What's Your Reaction?