Senior Citizen Savings Scheme: A Secure Haven for Retirement Income in India

Government of India introduced the Senior Citizen Savings Scheme (SCSS) in 2004. This government-backed scheme has emerged as a reliable and lucrative option for senior citizens seeking a steady income and secure investment avenue for their retirement savings.

Retirement marks a significant transition in life, often accompanied by changes in income and financial obligations. For senior citizens in India, navigating this phase can be particularly challenging, with rising healthcare costs and living expenses placing a strain on their finances. To address these concerns, the Government of India introduced the Senior Citizen Savings Scheme (SCSS) in 2004. This government-backed scheme has emerged as a reliable and lucrative option for senior citizens seeking a steady income and secure investment avenue for their retirement savings.

Understanding the SCSS:

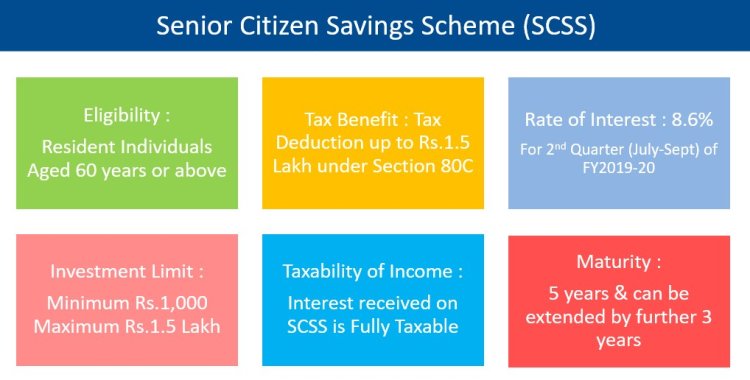

The SCSS is a deposit scheme specifically designed for Indian citizens aged 60 years and above. It offers a high interest rate on deposits compared to other traditional savings schemes, currently 8.20% per annum (as of January 2024). This translates to significantly higher returns on invested capital, providing senior citizens with a dependable source of income to meet their post-retirement needs.

Key Features and Benefits of the SCSS:

- High Interest Rate: As mentioned earlier, the SCSS currently offers an attractive interest rate of 8.20% p.a., significantly higher than regular savings accounts and fixed deposits. This ensures substantial returns on investments, aiding financial stability during retirement.

- Safe and Secure: Backed by the Government of India, the SCSS carries minimal risk of capital loss, making it a highly secure investment option for senior citizens. This feature is particularly appealing to those seeking stability and protection against market fluctuations.

- Flexible Tenure: The SCSS has a fixed tenure of 5 years, but it can be extended for 3 years at the current interest rate upon maturity. This flexibility allows individuals to tailor the scheme to their financial needs and goals.

- Regular Income: Interest earned on the SCSS account is credited quarterly, enabling regular income flow for senior citizens. This predictable income stream helps manage expenses and maintain financial security throughout retirement.

- Tax Benefits: Deposits made in the SCSS qualify for tax deductions under Section 80C of the Income Tax Act, up to a maximum of Rs. 1.5 lakhs per year. This benefit further enhances the attractiveness of the scheme for tax-conscious individuals.

- Ease of Operation: Opening an SCSS account is a simple process and can be done at any authorized bank branch or post office. The scheme requires minimal documentation and formalities, making it accessible to even those with limited financial experience.

- Transferability: SCSS accounts are transferable across India, offering convenience and flexibility for senior citizens who may relocate or change their place of residence.

Eligibility Criteria for the SCSS:

- Indian citizens aged 60 years and above are eligible to open an SCSS account.

- Individuals who have retired from government service are also eligible, regardless of their age.

- The scheme is available to resident individuals as well as Non-Resident Indians (NRIs).

Investment Limits and Options:

- The minimum deposit amount in an SCSS account is Rs. 1,000, while the maximum deposit limit is Rs. 15 lakhs.

- Individuals can open an SCSS account individually or jointly with their spouse.

- Deposits can be made in lump sum or through installments at the account holder's convenience.

Tax Implications:

- As mentioned earlier, deposits made in the SCSS qualify for tax deductions under Section 80C of the Income Tax Act, up to a maximum of Rs. 1.5 lakhs per year.

- The interest earned on the SCSS account is taxable as per the individual's income tax slab.

Comparing the SCSS with Other Investment Options:

Senior citizens often have a variety of investment options available to them. However, the SCSS stands out due to its unique combination of benefits:

- High Interest Rate: Compared to regular savings accounts and fixed deposits, the SCSS offers significantly higher returns, making it a more lucrative option for income generation.

- Government Guarantee: The backing of the Government of India ensures minimal risk of capital loss, unlike market-linked investments that carry inherent volatility.

- Tax Benefits: The tax deduction available on SCSS deposits further enhances its appeal compared to non-tax-exempt investment options.

- Regular Income: The quarterly interest payout provides a predictable income stream, unlike investments that may offer lump sum returns at maturity.

While the SCSS offers undeniable advantages, it's important to consider its limitations as well. The fixed tenure and maximum deposit limit may not be suitable for all individual needs. Additionally, the interest rate, though attractive, is subject to periodic revisions by the government.

Conclusion:

The Senior Citizen Savings Scheme has emerged as a cornerstone of financial security for senior citizens in India. Its high interest rate, safety, flexibility, and tax benefits make it a compelling option for those seeking a stable income and secure investment avenue during their retirement years. However, it's crucial to consider the scheme's limitations alongside its advantages.

Comparing the SCSS with Other Investment Options:

While the SCSS offers undeniable advantages, it's important to compare it with other investment options available to senior citizens. Here's a brief comparison:

| Feature | SCSS | Fixed Deposits | Mutual Funds | Equity Investments |

|---|---|---|---|---|

| Interest Rate | 8.20% p.a. (as of Jan 2024) | Varies depending on bank and tenure | Varies depending on mutual fund | Can vary significantly depending on market performance |

| Risk | Minimal | Low | Moderate to High | High |

| Liquidity | Premature withdrawals allowed with penalty, account matures in 5 years (extendable by 3 years) | Premature withdrawals allowed with penalty, tenure varies from few months to years | Some mutual funds allow partial withdrawals, others have lock-in periods | Highly liquid, but market fluctuations can impact value |

| Tax Benefits | Deduction under Section 80C up to Rs. 1.5 lakhs | Available on specific types of FDs under Section 80C | Applicable only on dividends reinvested (LTCG applicable on capital gains) | Applicable only on long-term capital gains |

| Investment Limit | Rs. 1,000 to Rs. 15 lakhs | Varies depending on bank and tenure | Varies depending on mutual fund | No fixed limit, but high investment amounts recommended for diversification |

As evident from the comparison, the SCSS offers a unique combination of safety, guaranteed returns, and tax benefits, making it a particularly attractive option for risk-averse senior citizens seeking a steady income stream. However, for those with a longer investment horizon and higher risk tolerance, exploring other options like mutual funds or carefully-chosen equities may offer potentially higher returns over the long term.

Additional Considerations:

It's important to remember that the SCSS is just one piece of a comprehensive financial plan for retirement. Senior citizens should consider their individual financial goals, risk tolerance, and other income sources when making investment decisions. Consulting with a financial advisor can be highly beneficial in navigating the retirement landscape and creating a personalized financial plan that aligns with their specific needs and aspirations.

Beyond the SCSS:

While the SCSS is an excellent option for many senior citizens, it's crucial to acknowledge that it may not be suitable for everyone's unique circumstances. Here are some additional considerations for those who may not find the SCSS ideal:

- Limited Investment Amount: The maximum deposit limit of Rs. 15 lakhs may not be sufficient for individuals with substantial retirement savings looking for larger returns.

- Fixed Tenure: The 5-year tenure, with a 3-year extension option, might not be suitable for those seeking longer-term investment options.

- Lower Potential Returns Compared to Some Higher-Risk Options: For individuals with a higher risk tolerance and longer investment horizons, exploring other options like mutual funds or carefully-chosen equities may offer potentially higher returns over the long term.

Final Thoughts:

The Senior Citizen Savings Scheme undeniably serves as a valuable financial tool for Indian senior citizens, offering security, stability, and predictable income in their post-retirement years. However, it's crucial to recognize that it's not a one-size-fits-all solution. By carefully considering the scheme's features, limitations, and comparing it with other available options, senior citizens can make informed investment decisions that align with their unique financial goals and risk tolerance, paving the way for a secure and fulfilling retirement.

Remember, retirement planning is a continuous process, and revisiting your financial strategy periodically is essential to adapt to changing circumstances and market conditions. By combining the SCSS with other suitable investment options and seeking professional guidance when needed, senior citizens can navigate the financial landscape of retirement with confidence and ensure a comfortable and secure golden age.

Disclaimer:

This article is intended for informational purposes only and should not be considered financial advice. Individual circumstances may vary, and it is essential to consult with a qualified financial advisor before making any investment decisions. The information presented here is based on publicly available data and may be subject to change due to government regulations or policy revisions. The author and publisher cannot be held liable for any inaccuracies or losses incurred as a result of relying on the information provided in this article.

Important Links:

- Ministry of Finance, Government of India: https://finmin.nic.in/

- Senior Citizen Savings Scheme (SCSS) Guidelines: https://sbi.co.in/web/personal-banking/investments-deposits/govt-schemes/senior-citizens-savings-scheme

- Tax Benefits for Senior Citizens: https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-2

- Financial Planning for Retirement: https://investor.sebi.gov.in/pdf/reference-material/retiredpeople.pdf

Remember, financial planning is a personal journey, and tailoring your investments to your unique needs and goals is key to ensuring a secure and prosperous retirement. By actively seeking information, staying informed, and seeking professional guidance when necessary, you can navigate the financial landscape with confidence and create a golden age filled with joy and peace of mind.

What's Your Reaction?