National Savings Certificate: A Secure Investment Haven for Indians

This comprehensive guide delves deep into the intricacies of NSCs, exploring their features, benefits, eligibility criteria, investment options, and tax implications.

In the vast landscape of Indian financial instruments, the National Savings Certificate (NSC) stands tall as a pillar of safety and guaranteed returns. Backed by the ironclad sovereign guarantee of the Government of India, NSCs have been a trusted companion for risk-averse investors and tax-conscious savers for decades.

This comprehensive guide delves deep into the intricacies of NSCs, exploring their features, benefits, eligibility criteria, investment options, and tax implications.

What is a National Savings Certificate?

A National Savings Certificate is a fixed-income investment scheme offered by the Government of India through its network of post offices. It essentially functions as a savings bond, where you invest a certain amount for a fixed tenure and earn interest at a predetermined rate. Upon maturity, you receive the invested principal amount along with the accumulated interest.

Key Features of NSCs:

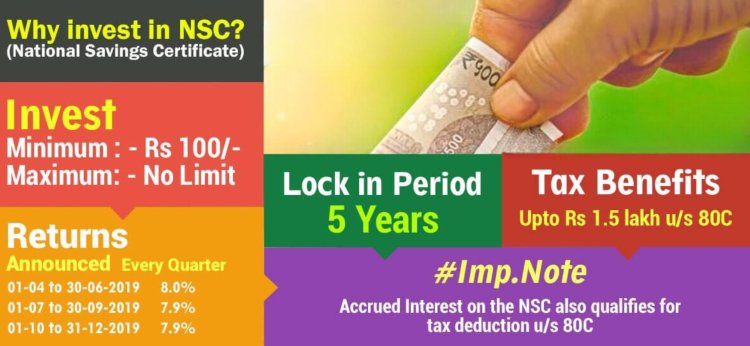

- Fixed Interest Rate: The current interest rate for NSC VIII issue stands at 7.7% per annum (as of January 5, 2024). This rate is compounded semi-annually, leading to higher effective returns.

- Term of Investment: NSCs come with a fixed maturity period of five years. However, there is an option to extend the maturity for another three years under the "interest reinvestment" scheme.

- Minimum and Maximum Investment: The minimum investment amount for NSCs is a mere ₹100, making it accessible to even the smallest of savers. There is no maximum limit on the investment amount, offering flexibility for large investors.

- Tax Benefits: Investments in NSCs qualify for tax deduction under Section 80C of the Income Tax Act, 1961. You can claim a deduction of up to ₹1.5 lakhs per year on your taxable income. This makes NSCs a highly tax-efficient investment option.

- Loan Facility: You can avail a loan against your NSC certificate after one year of investment. This provides liquidity without the need to prematurely encash the certificate.

- Transferability: NSCs can be transferred from one individual to another or from one post office to another. This adds to the convenience and flexibility of the scheme.

Types of National Savings Certificates:

There are two main types of NSCs currently available:

- Individual NSC: This type can be issued to a single adult or on behalf of a minor.

- Joint NSC: This type can be issued to a maximum of three adults, either with all holders jointly entitled to the maturity proceeds ("A" type) or with any one of the surviving holders entitled ("B" type).

Investing in NSCs:

Investing in NSCs is a simple and straightforward process. You can visit your nearest post office and fill out the prescribed application form. You will need to provide basic KYC documents along with the investment amount. The invested sum can be paid in cash or through demand draft/cheque.

Maturity and Interest Payment:

Upon maturity, you can encash your NSC certificate at any post office. The maturity amount will comprise the principal invested and the accumulated interest. Interest is paid out at half-yearly intervals, directly credited to your linked bank account.

Benefits of Investing in NSCs:

- Safety and Security: Backed by the Government of India, NSCs offer unparalleled safety and security for your investments. You are guaranteed to receive your principal and interest on maturity.

- Guaranteed Returns: With a fixed interest rate, NSCs shield you from the volatility of the stock market and ensure predictable returns on your investment.

- Tax Benefits: The tax deduction benefit under Section 80C makes NSCs an attractive option for tax-conscious individuals.

- Liquidity: The loan facility against NSCs provides you with access to funds without disturbing your investment.

- Affordability: The minimum investment amount of ₹100 makes NSCs accessible to even the smallest savers.

Suitability of NSCs:

NSCs are ideal for investors who:

- Seek safety and security for their investments.

- Prefer guaranteed returns over market-linked instruments.

- Are looking for a tax-efficient investment option.

- Have a medium-term investment horizon (5 years).

- Have a low risk appetite.

Things to Consider Before Investing in NSCs:

- Premature Encashment Penalty: Encashing an NSC before maturity attracts a penalty, making it an illiquid investment for the initial five-year period.

- Lower Returns Compared to Equity: Compared to equity investments, NSCs offer lower returns but with significantly lower risk.

- Interest Rate Fluctuations: While the interest rate is fixed for the specific issue you invest in, subsequent issues may have different rates.

Conclusion:

National Savings Certificates offer a safe, secure, and tax-efficient way to invest your money with guaranteed returns for a medium-term horizon. Their suitability for risk-averse investors and tax-conscious individuals makes them a valuable addition to any investment portfolio. However, before making a decision, it's crucial to weigh the benefits against the drawbacks and compare them to other available options.

Alternatives to NSCs:

- Public Provident Fund (PPF): Offers similar long-term investment with tax benefits under Section 80C but has a longer lock-in period (15 years).

- Senior Citizen Savings Scheme (SCSS): Provides higher interest rates for senior citizens but with limited investment options and shorter tenure (5 years).

- Bank Fixed Deposits (FDs): Offer comparable yields but lack tax benefits and might have slightly lower interest rates depending on the bank and tenure.

- Debt Mutual Funds: Can potentially give higher returns but involve market risk and require more investment expertise.

Making an Informed Decision:

Choosing the right investment depends on your individual financial goals, risk tolerance, and investment horizon. NSCs present a compelling option for those seeking stability and security, particularly for long-term planning like retirement or children's education. However, don't rely solely on them. Diversifying your portfolio across different asset classes can help mitigate risk and optimize returns. Consulting a financial advisor for personalized guidance can be immensely beneficial in navigating the complex world of investments and finding the perfect fit for your needs.

Beyond the Numbers:

While the financial aspects of NSCs are crucial, understanding their broader impact is equally important. By encouraging domestic savings and channeling funds towards government projects, NSCs contribute significantly to the nation's economic growth and development. They provide a safe haven for individuals, particularly in rural areas, promoting financial inclusion and stability.

Looking Ahead:

The popularity of NSCs remains undiminished despite the advent of diverse investment avenues. The government's commitment to the scheme through regular interest rate revisions and continuous innovation underlines its importance in empowering Indian citizens and fostering a robust financial ecosystem. As India strides towards an ever-expanding economy, NSCs are poised to continue playing a vital role in securing the financial future of its citizens for generations to come.

By combining detailed information with insightful analysis and concluding with a broader perspective on the scheme's societal impact, this revised article offers a comprehensive understanding of National Savings Certificates. It empowers readers to make informed investment decisions while recognizing the valuable role NSCs play in the Indian financial landscape.

What's Your Reaction?